Medical Insurance: Your Complete Guide to Making Smart Healthcare Decisions

Now a days, Healthcare costs have been rising very fast and rapidly, and a single hospitalization can destroy your whole savings and investments faster than you imagine. Literally "one hospitalization away from bankruptcy", if you don't have proper health insurance. If you're reading this, you're probably wondering whether medical insurance is worth it, or maybe you're confused by all the jargon and options available.

Don't worry – I was also there in that phase. After spending hours researching policies for my family and dealing with claim processes, I'm sharing everything you need to know about medical insurance.

Why Medical Insurance Has Become Essential (Not Optional)

Let's start with some reality checks that might surprise you:

Key Statistics:

- Average cost of heart surgery: ₹3-5 lakhs

- ICU charges in metro cities: ₹8,000-15,000 per day

- Cancer treatment costs: ₹10-25 lakhs

- 70% of Indians pay medical expenses out of pocket

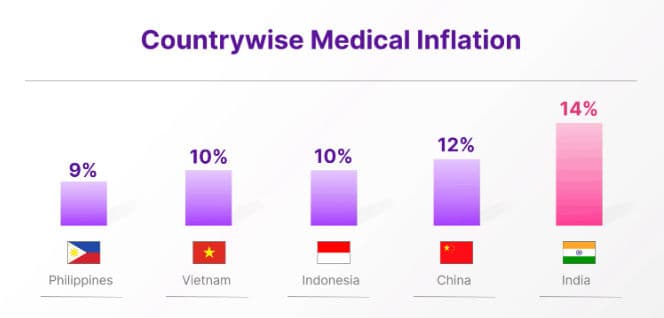

- Medical inflation rate: 12-15% annually

Understanding Medical Insurance: The Basics

Medical insurance (also called health insurance) is basically a safety net. You pay a small amount annually (premium), and in return, the insurance company covers your medical expenses up to a certain limit (sum insured).

Types of Medical Insurance in India

1. Individual Health Insurance

- Covers only you

- Premium based on your age and health

- Best for: Single individuals, customized coverage

2. Family Floater Plans

- One policy covers entire family

- Premium generally lower than individual policies

- Best for: Young families with healthy members

3. Group Insurance (from employer)

- Provided by your company

- Usually basic coverage

- Best for: Additional backup, not primary coverage

4. Senior Citizen Plans

- Designed for people above 60

- Higher premiums but essential coverage

- Best for: Elderly parents

How Much Coverage Do You Really Need?

This is probably the most common question I get. Here's my practical approach:

By City Tier:

- Metro cities (Mumbai, Delhi, Bangalore): ₹10-15 lakhs minimum

- Tier-2 cities (Pune, Ahmedabad, Jaipur): ₹5-10 lakhs

- Tier-3 cities and towns: ₹3-5 lakhs

By Family Size:

- Individual: ₹5-10 lakhs

- Couple: ₹8-15 lakhs

- Family with children: ₹10-20 lakhs

Pro tip: Start with what you can afford, then increase coverage as your income grows. It's better to have some insurance than none at all.

Key Features You Must Look For

After dealing with multiple insurance companies, here are the features that actually matter:

Essential Features:

- Cashless hospitalization - Pay nothing at network hospitals

- Room rent capping - Should be at least 2% of sum insured

- Pre and post hospitalization - 60 days pre, 90 days post minimum

- Day care procedures - Covers treatments not requiring overnight stay

- Ambulance charges - Usually ₹1,000-2,000 per incident

Advanced Features (Nice to Have):

- No claim bonus - Increases coverage for claim-free years

- Restoration benefit - Refills sum insured if exhausted

- Health checkups - Free annual checkups

- Alternative treatments - Ayurveda, homeopathy coverage

Top Insurance Companies in India (2025)

Based on claim settlement ratio and customer reviews:

- HDFC ERGO

- TATA AIG

- ICICI Lombard

- Star Health

- Max Bupa

- Bajaj Allianz

My personal recommendation: Don't just go by settlement ratios. Check network hospitals in your city, read customer reviews, and compare premium costs.

Always go with good brands.

How to Buy Medical Insurance (Step by Step)

Step 1: Calculate Your Needs

- List family members to be covered

- Research hospital costs in your city

- Decide between individual vs. family floater

Step 2: Compare Policies

Use comparison websites like:

- PolicyBazaar

- Coverfox

- InsuranceDekho

- Ditto

Step 3: Read the Fine Print

- Waiting periods

- Exclusions

- Room rent limits

- Network hospitals

Step 4: Buy Online vs. Agent

- Online: Cheaper, faster, direct control

- Agent: Personal guidance, claim assistance

My advice: Buy online if can research on your own. Use agents if you need hand-holding, It will help better at the time of hospitalization.

Common Mistakes to Avoid

From my experience and talking to others, here are the biggest mistakes:

1. Buying Too Late

Starting insurance at 40+ means higher premiums and longer waiting periods. Start young, even with basic coverage.

2. Relying Only on Employer Insurance

Company insurance stops when you leave. Always have personal coverage.

3. Not Disclosing Medical History

Non-disclosure can lead to claim rejection. Be honest during application.

4. Choosing Based on Premium Alone

Cheapest isn't always best. Check network hospitals, claim process, and customer service.

5. Not Reading Policy Documents

The devil is in the details. Read waiting periods, exclusions, and claim procedures.

Tax Benefits: Save Money While Staying Protected

Medical insurance premiums qualify for tax deduction under Section 80D in Old Tax Regime:

Tax Deduction Limits:

- Self and family: Up to ₹25,000

- Parents (below 60): Additional ₹25,000

- Parents (above 60): Additional ₹50,000

- Senior citizens: Up to ₹50,000 for self

Example: If you're in 30% tax bracket and pay ₹25,000 premium, you save ₹7,500 in taxes.

Making Your Decision: A Practical Approach

Here's my simple framework for choosing medical insurance:

Step 1: Budget First

Decide how much you can afford annually. Generally, 2-3% of annual income is reasonable.

Step 2: Coverage Amount

Use the city-wise guide I mentioned earlier, but adjust based on your family's health history.

Step 3: Company Selection

Pick from top 5 companies based on:

- Network hospitals in your area

- Claim settlement track record

- Customer service reviews

Step 4: Policy Features

Must-haves first, then nice-to-haves if budget allows.

Final Thoughts

Medical insurance isn't just about money – it's about peace of mind. I've seen families avoid necessary treatments because of cost concerns, and others who could focus on recovery because insurance handled the bills.

Start somewhere, even if it's basic coverage. You can always upgrade later. The key is to have something in place before you need it.

Action Items:

- Calculate your family's coverage needs today

- Compare 3-4 policies from different companies

- Buy before your next birthday (premiums increase with age)

- Set a calendar reminder to review your policy annually

Remember, the best medical insurance is the one you have when you need it. Don't wait for a health scare to realize its importance.

This guide is based on current regulations and market practices as of 2025. Insurance terms and conditions can change, so always read the latest policy documents before purchasing.

Have questions about medical insurance? Feel free to ask in the comments below. I try to respond to every query based on my research and experience.

Disclaimer: This is educational content and not personalized insurance advice. Please consult with insurance advisors for specific recommendations.

Comments

Loading comments...