AI-Assisted Financial Planning: How Artificial Intelligence Is Transforming Personal Finance

Personal finance is going through one of the biggest transformations in decades. What earlier required spreadsheets, manual tracking, and periodic reviews is now being handled by AI-powered tools that work silently in the background — analysing, predicting, and guiding our financial decisions. Let’s break down how AI-assisted financial planning works, why it matters, and what it means for individuals across age groups.

📌 What Is AI-Assisted Financial Planning?

AI-assisted financial planning uses machine learning, data analytics, and automation to help individuals manage money more efficiently.

Unlike traditional tools that only record data, AI systems:

- Learn from your spending and income patterns

- Predict future cash flows

- Provide personalized insights

- Suggest actions automatically

In short, AI doesn’t just show your finances — it interprets them.

💸 Smarter Expense Tracking (Beyond Categories)

Traditional expense trackers merely label expenses as “Food”, “Rent”, or “Travel”. AI takes this further.

How AI improves expense tracking:

- Detects behavioral spending patterns (weekend overspending, impulse buys)

- Flags unusual or risky transactions

- Identifies subscription leakage (unused OTTs, apps, memberships)

- Predicts upcoming expenses based on past data

👉 Example: Instead of saying “You spent ₹8,000 on food”, AI might say:

“Your food spending rises by 22% in the last week of every month — consider setting a soft limit.”

That insight is powerful.

💰 Automated Saving Habits (Saving Without Thinking)

One of the biggest challenges in personal finance is consistency. AI solves this using automation + intelligence.

How AI helps automate savings:

- Analyses your income and fixed obligations

- Identifies surplus cash dynamically

- Moves small, safe amounts into savings or investments

- Adjusts saving levels if income or expenses change

This is often called “invisible saving” — saving money without feeling restricted.

For young professionals and salaried individuals, this removes the mental friction associated with saving.

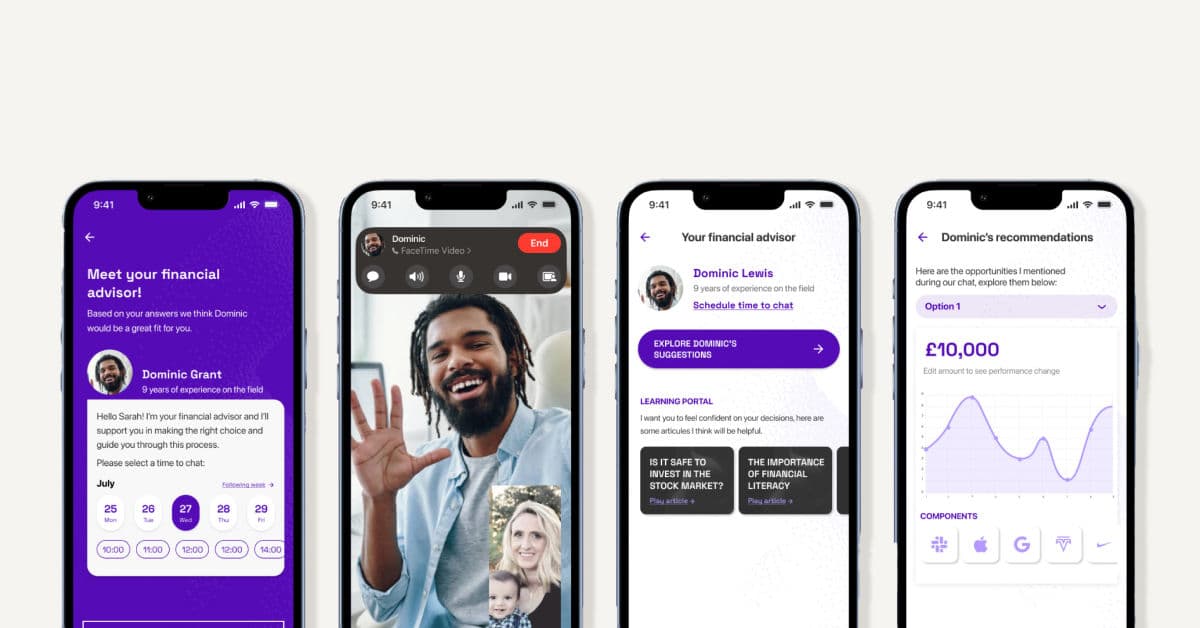

📈 Personalized Investment Suggestions

AI-driven financial tools are changing how people invest.

Try Personalized FinanceKT AI Tool

What makes AI investment guidance different?

- Risk profiling based on behavior, not just questionnaires

- Goal-based asset allocation (retirement, house, child education)

- Automatic rebalancing suggestions

- Simulation of “what-if” scenarios

Instead of generic advice like “invest aggressively when young”, AI can suggest:

“Based on your income stability and spending pattern, a 70:30 equity-debt allocation suits you better.”

This personalization is what sets AI apart from traditional advisory models.

👨👩👧 AI for Different Life Stages

AI-assisted finance is not limited to one age group.

👩💼 Young Professionals

- Expense discipline

- Automated SIPs

- Emergency fund planning

💑 Couples & Families

- Shared budgets

- Goal prioritization (home, education, travel)

- Cash-flow forecasting

👴 Retirees

- Withdrawal planning

- Longevity risk estimation

- Medical expense forecasting

AI adapts its recommendations as life circumstances evolve, something static financial plans often fail to do.

🧠 Behavioral Finance: AI’s Hidden Superpower

Most financial mistakes are emotional, not mathematical.

AI tools use behavioral finance insights to:

- Reduce impulse spending

- Encourage long-term thinking

- Provide timely nudges instead of lectures

- Replace guilt with gentle course correction

This is especially useful during market volatility when fear and greed dominate decisions.

🔐 Is AI Financial Planning Safe?

A common concern.

Modern AI-based financial platforms prioritize:

- Bank-grade encryption

- Read-only access to accounts

- Regulatory compliance

- User-controlled permissions

While no system is perfect, AI tools often reduce human error and bias — a major source of financial missteps.

🚀 Why AI-Assisted Financial Planning Matters

Here’s the bigger picture:

- 🕒 Saves time

- 📊 Improves decision quality

- 🧩 Simplifies complexity

- 🎯 Aligns money with life goals

- 🔄 Adapts as life changes

AI doesn’t replace financial knowledge — it amplifies it.

🧩 Final Thoughts

Personal finance is shifting from manual control to intelligent oversight.

AI-assisted financial planning empowers individuals to:

- Make data-driven decisions

- Stay disciplined without stress

- Focus on life, not spreadsheets

In the coming years, managing money without AI may feel like navigating with a paper map in a GPS world.

Comments

Loading comments...